Smarter claim handling

RIFT asked me to redesign how agents capture and progress tax claims, turning a slow, error-prone process into a streamlined digital workflow.

The challenge

For years, RIFT’s contact centre agents had been using limited, generalist software to record claim information from customers.

Despite making up to 100 calls a day, agents had no dedicated system for the task. Data was entered into a generic account area, leading to inconsistent capture and unnecessary rework.

RIFT asked me to design a purpose-built application for their staff — a tool that didn’t just passively store information, but actively guided agents through the claim process.

What I did

- Client

- RIFT

- Product

- Workflow

- Feature

- Conversion Wizard

- Tools

- Figma, HTML, SCSS

Understanding the process

Before proposing solutions, I needed to understand how claims were handled end to end — how data was captured, and where agents were slowed down or tripped up.

I met with stakeholders across the claim process to hear both how the current system worked and what they hoped a better future might look like.

Beyond interviews, I spent hours listening in on live customer calls. Seeing agents capture information first-hand revealed clear opportunities for software to remove friction and improve consistency.

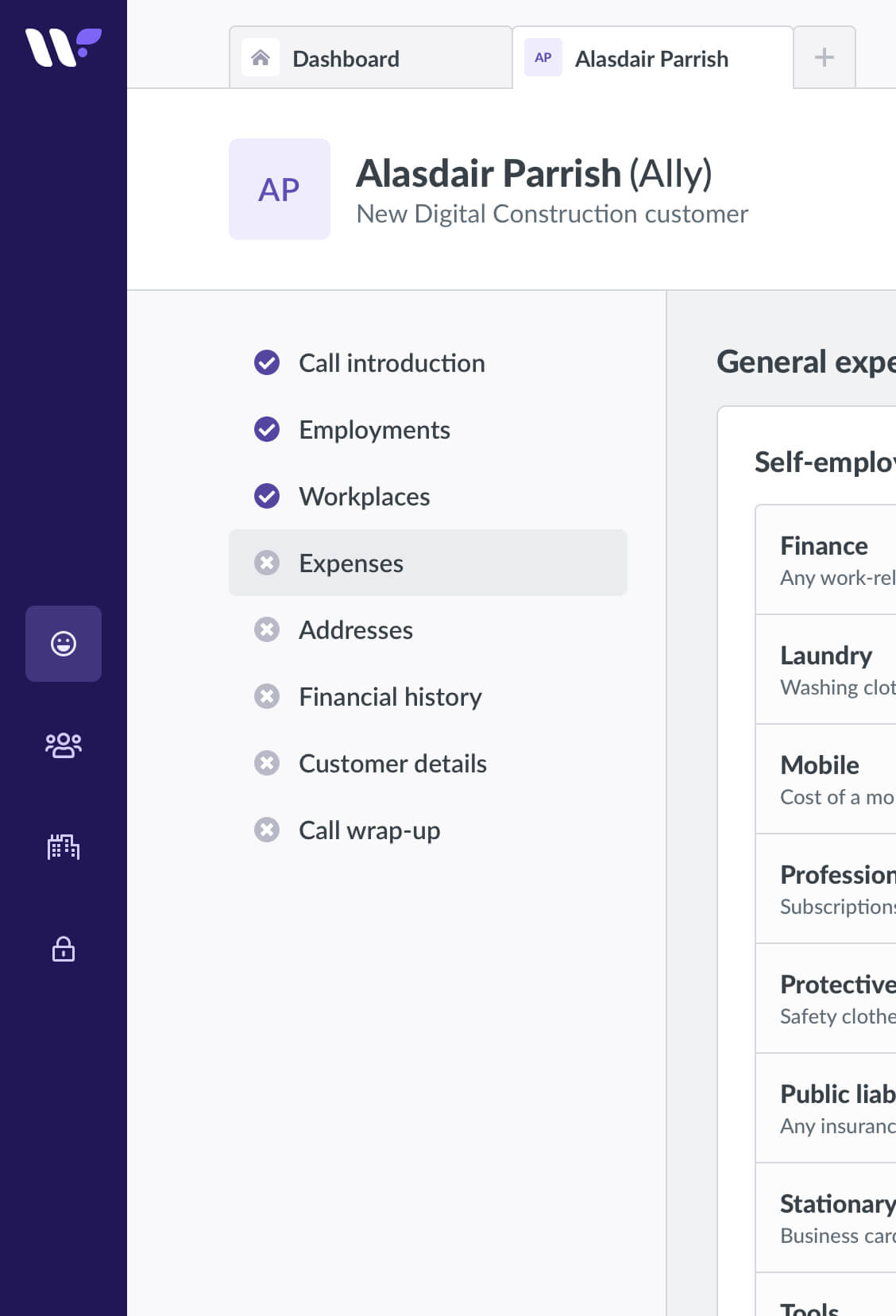

A natural, logical order

The application RIFT’s agents used to capture customer details was functional, but it offered little guidance in how claims should be structured.

Agents had complete freedom to enter information in any order, but in practice many parts of the process were closely related, and the most effective path was linear.

Certain answers directly shaped which questions came next. By defining a logical sequence, we created a shorter, more focused journey that cut duplication and made data capture more consistent.

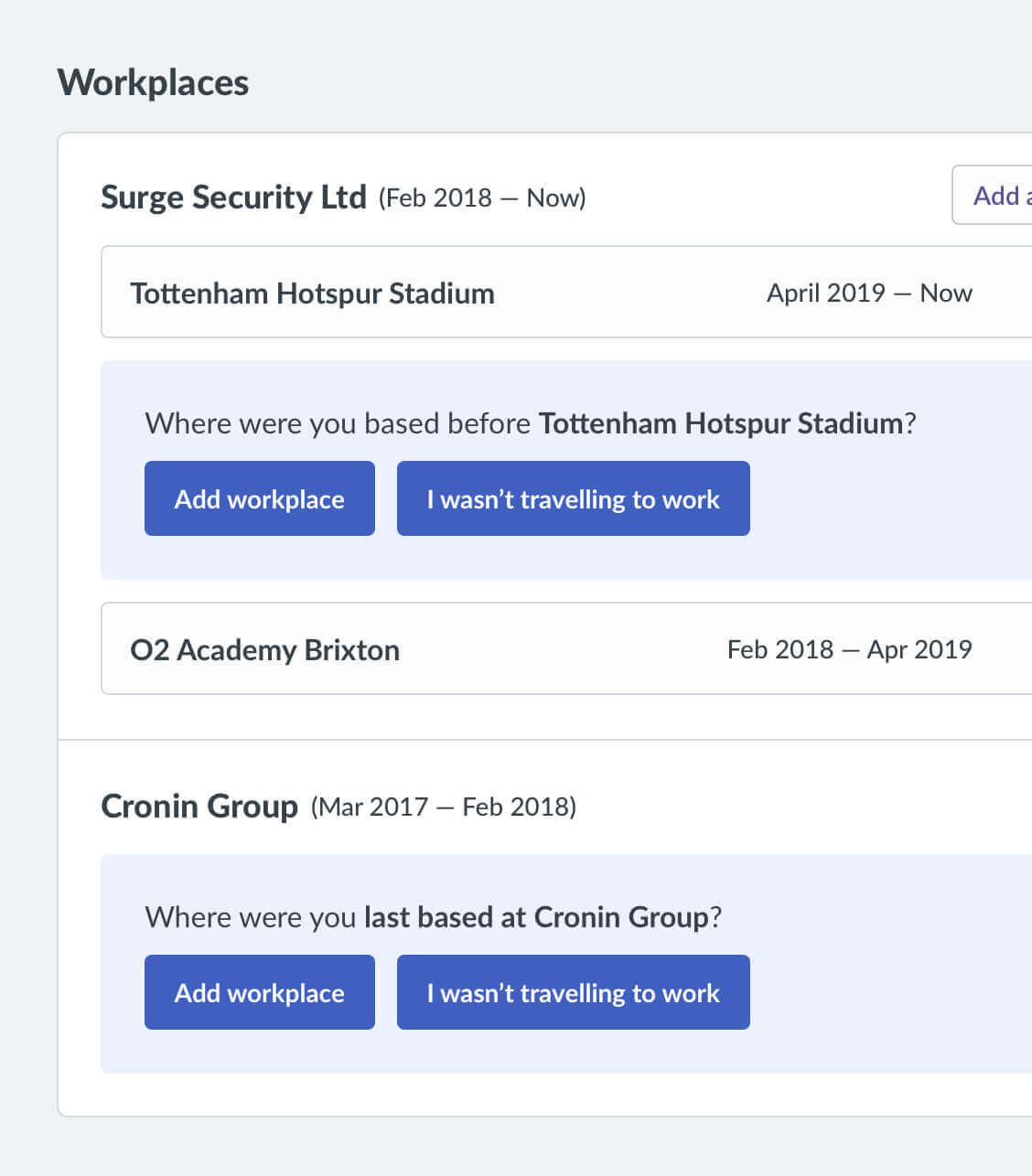

Long-form, reusable questions

The agent workflow closely mirrored RIFT’s online customer tool, MyRIFT.

Where possible, we reused the order, wording, and explanatory content from MyRIFT. This avoided duplicate work and reduced the overhead of maintaining content in two places.

By phrasing questions so they could be read verbatim to customers, less experienced agents gained built-in guidance on how to frame conversations, leading to more consistent data capture.

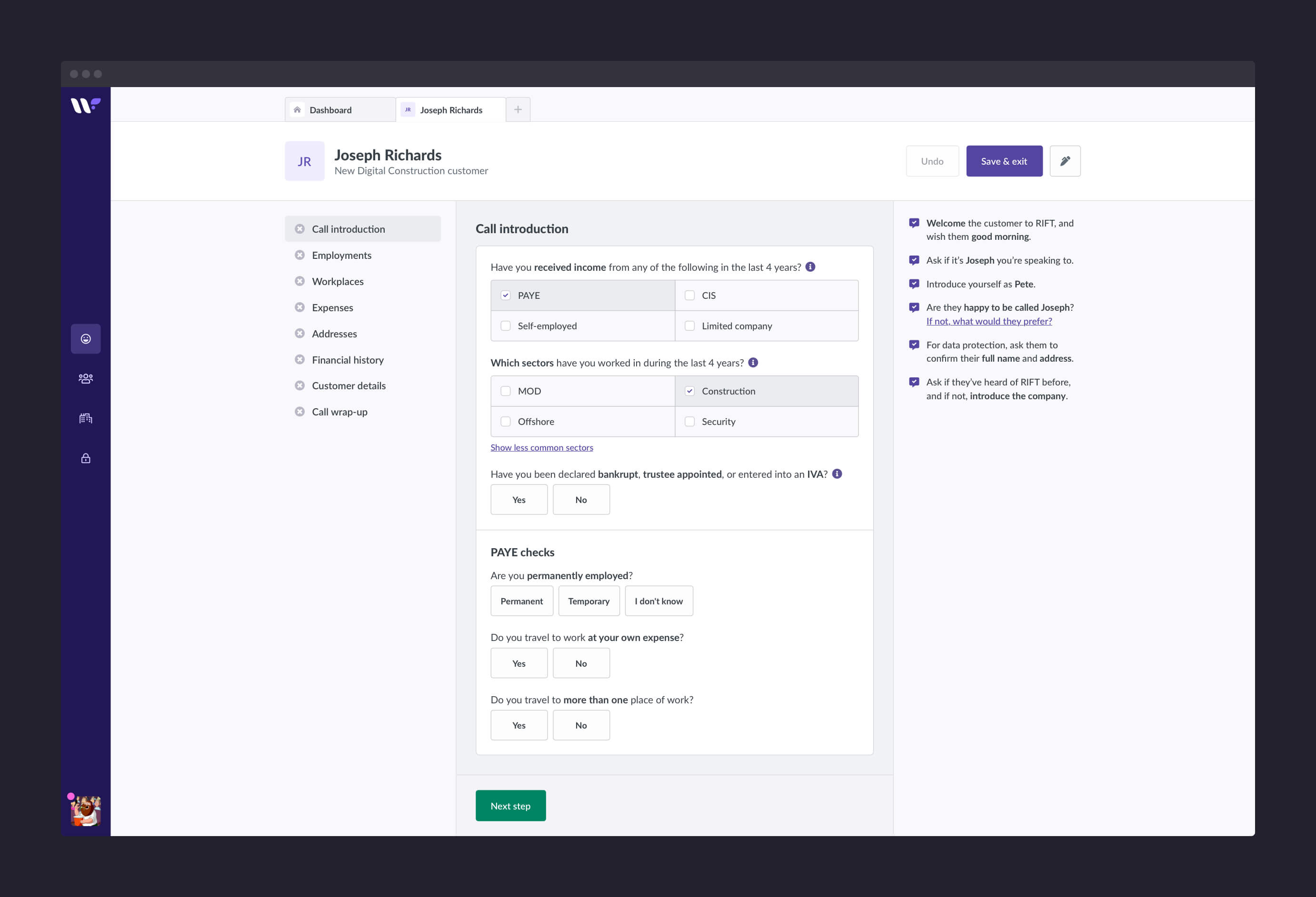

Call scripts

Because the web forms agents used were multipurpose, they offered little guidance in navigating a customer call.

By recognising the sequential nature of the process, we introduced a loose call script. This gave calls more structure and consistency, while allowing the system to surface hints, suggestions, and shortcuts at exactly the right moment — reducing cognitive load and speeding up interactions.

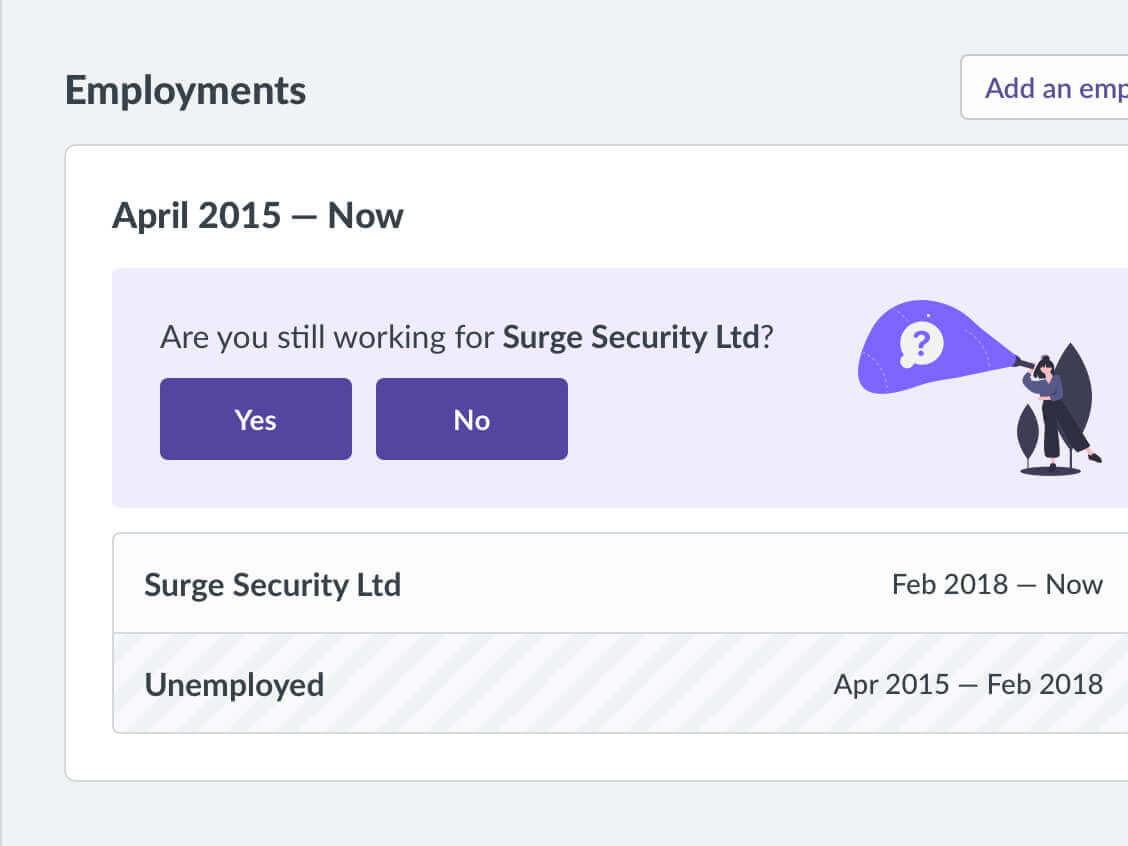

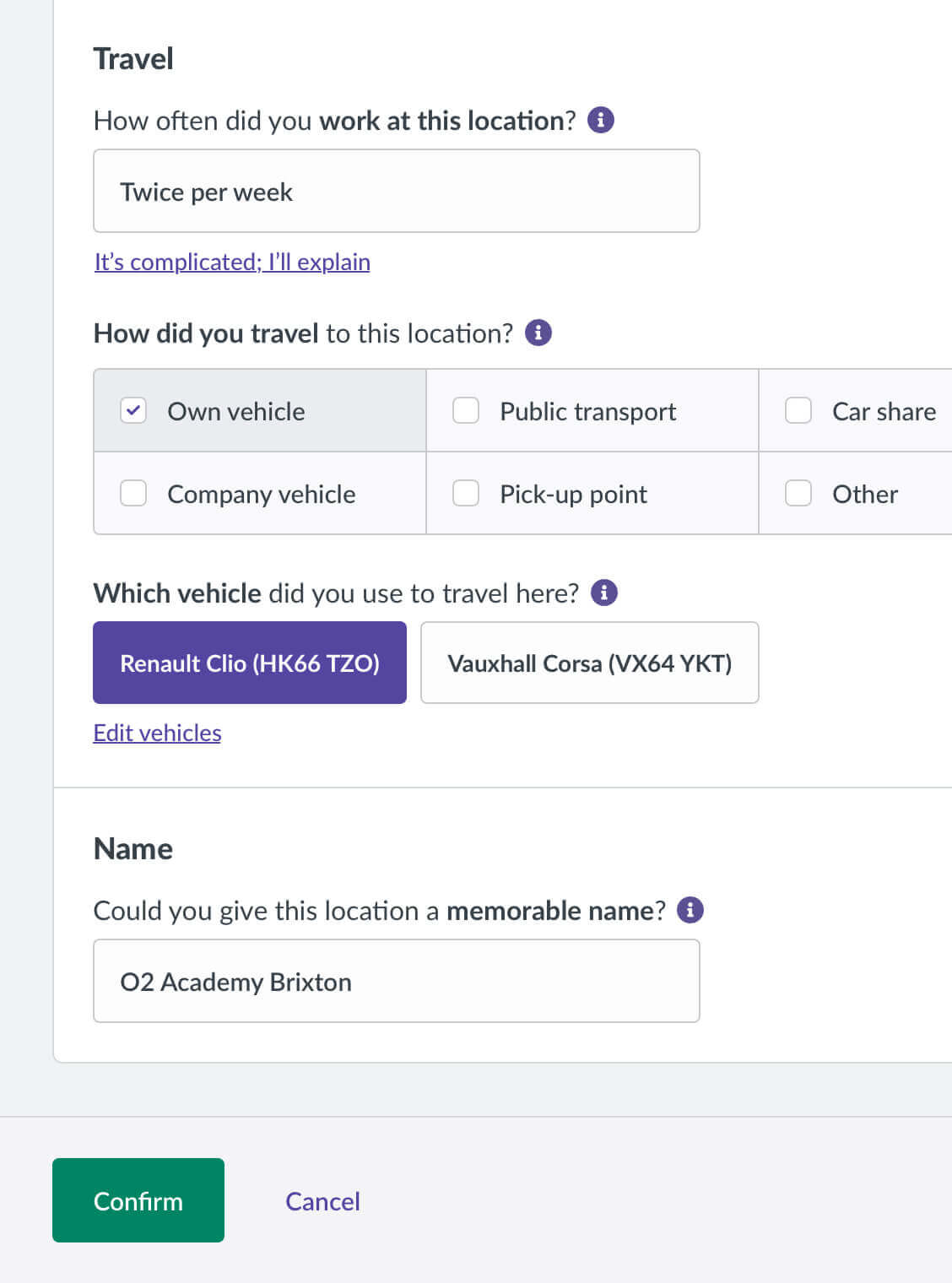

Claim timelines

Because tax claims span up to four years, agents needed to capture complete employment timelines.

The old system had no way to show gaps. A missing four months might have been an undisclosed job — or simply time out of work — but it went unflagged.

Listening to calls revealed that agents naturally used each answer to shape the next question. For example, after recording “employed by the MOD,” the next question would be “where did you work before the MOD?”

I proposed a timeline model: start with one anchor question, then generate follow-ups relative to the last answer until the entire period was accounted for. This gave agents confidence that claims were complete and ensured refunds covered the full entitlement.

This approach mirrored how agents already thought, but made it reliable, repeatable, and easier to scale across the team.

We worked with Chris to make our internal data capture tool easier to use. He didn't just make the application look great, but really 'got under the bonnet' in fully understanding the process and the problems before making his recommendations.

Throughout the project, Chris produced excellent documents, wireframes, and prototypes to help with stakeholder sign-off and handover to our development team.

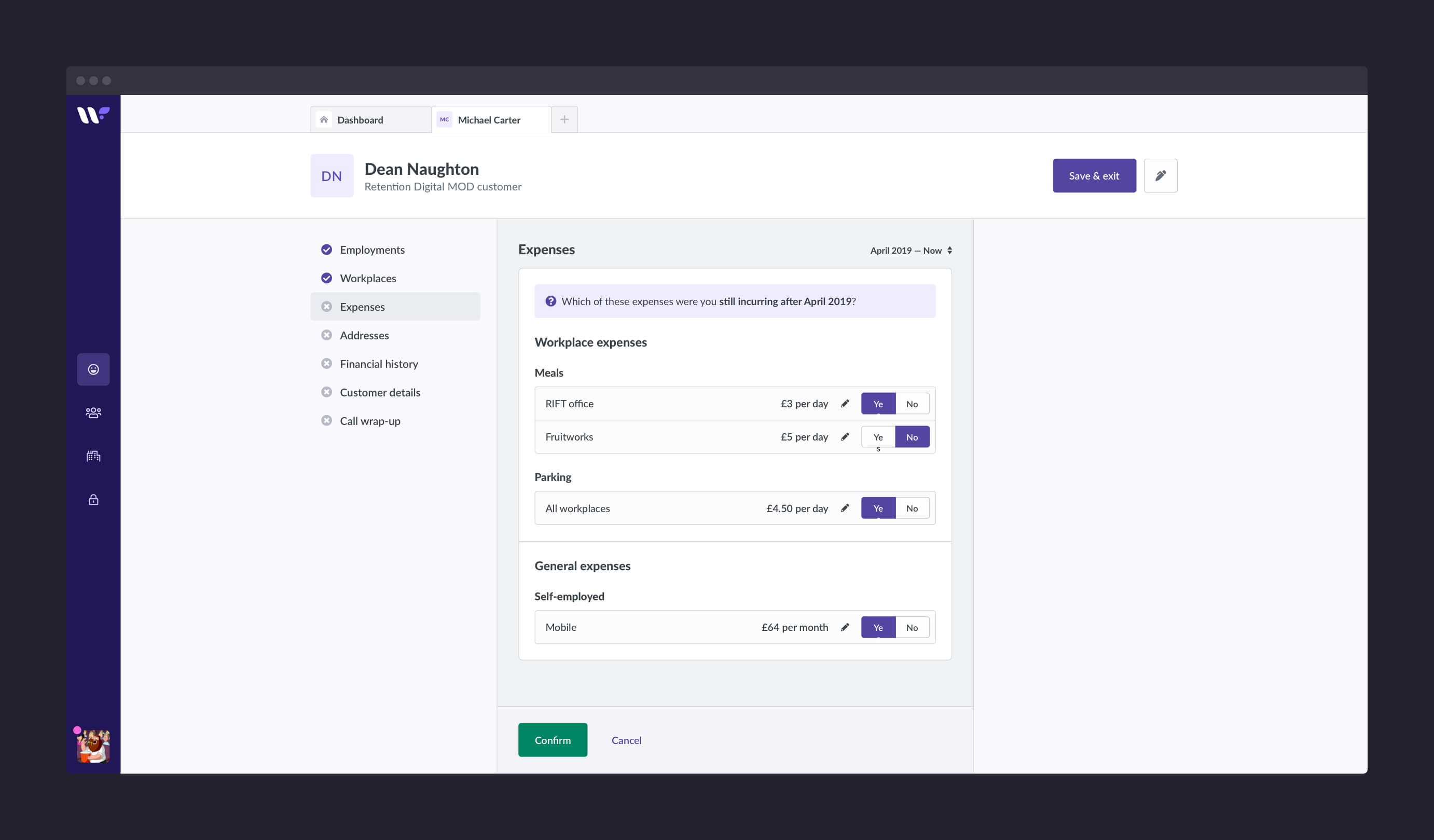

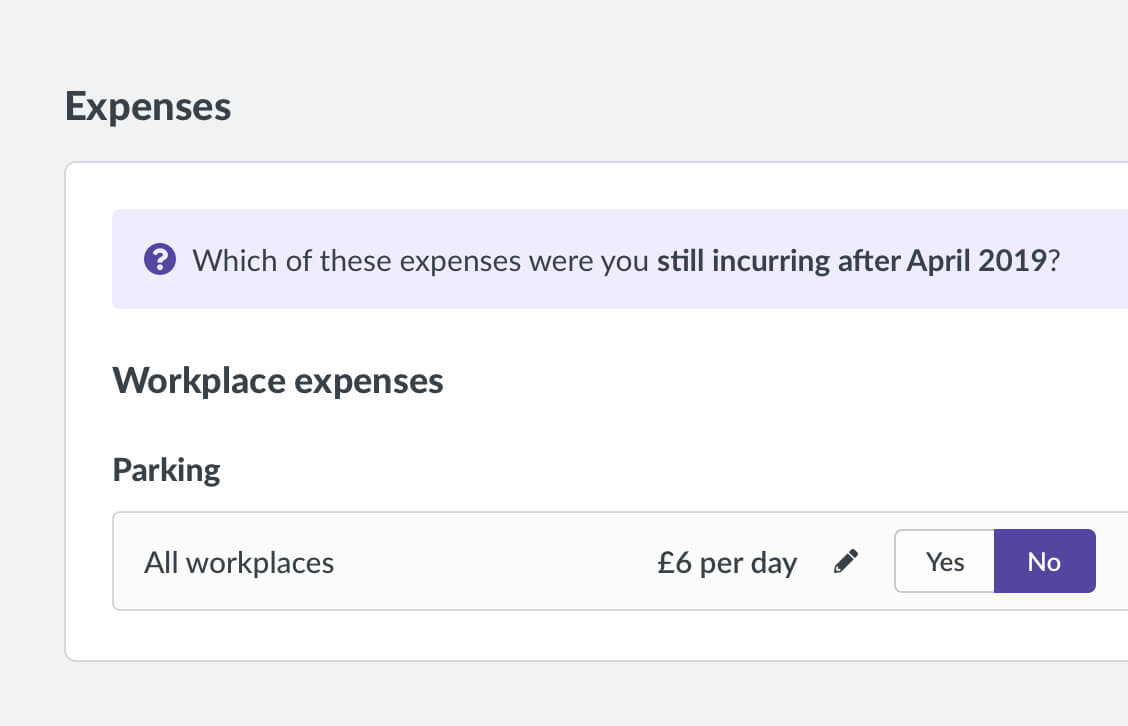

Expenses rework

Workplace vs. General

Previously, all expenses were captured equally, regardless of context.

From reviewing expense types, it became clear they fell into two categories: workplace-specific and general. By linking workplace expenses (like meals while posted in London vs. Leeds) to existing location data, we could infer dates automatically. This reduced the number of follow-up questions and simplified the process for both agents and customers.

It also reduced errors, since agents no longer had to remember to manually match dates and costs.

Just as importantly, it created a more consistent experience for customers. Agents no longer needed to ask repetitive clarifying questions, which kept calls flowing smoothly and made the overall process feel more professional.

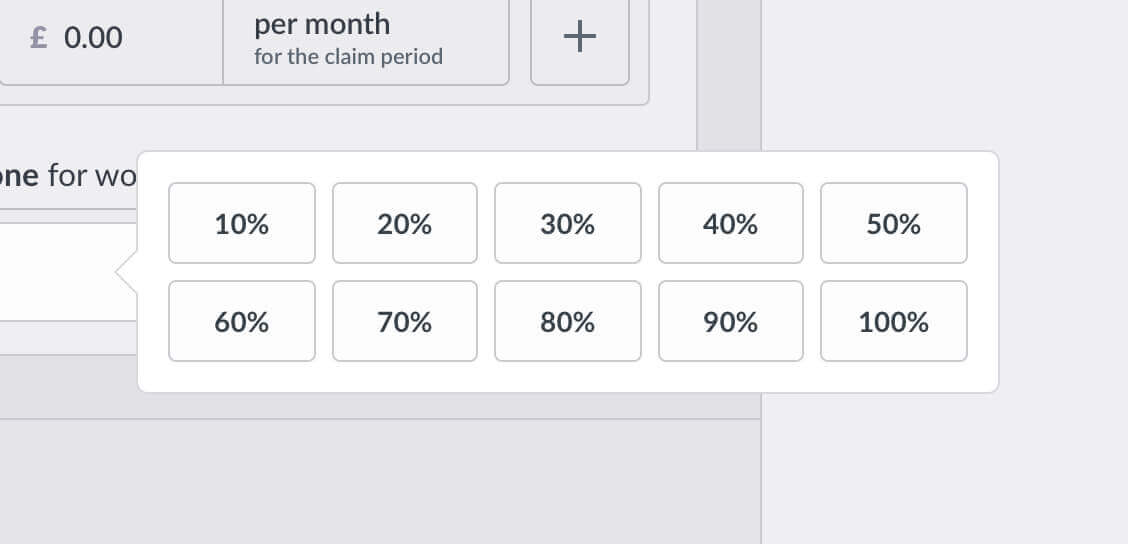

Custom expense component

Some expenses are inherently complex — different types, costs, frequencies, and date ranges, sometimes with multiple entries of the same type.

I designed a two-step flow: first capture location-specific expenses, then general business costs. Defaults (e.g. meals daily, phones monthly) kept data entry quick, while agents could adjust frequency or add exceptions when needed.

This balance of sensible defaults with flexible overrides gave agents confidence in the data captured while cutting down unnecessary questions.

It also set a clear pattern for how future expense types could be added without redesigning the whole system, making the tool easier to maintain and scale over time.

Retention review process

Because claims are annual, a long time can pass between a customer’s first and second, and some past expenses may no longer apply.

The Conversion Wizard adds a step for returning customers: agents review past expenses, discard what’s no longer applicable, and automatically carry forward everything else. This keeps new claims accurate while saving agents from re-entering large amounts of data.

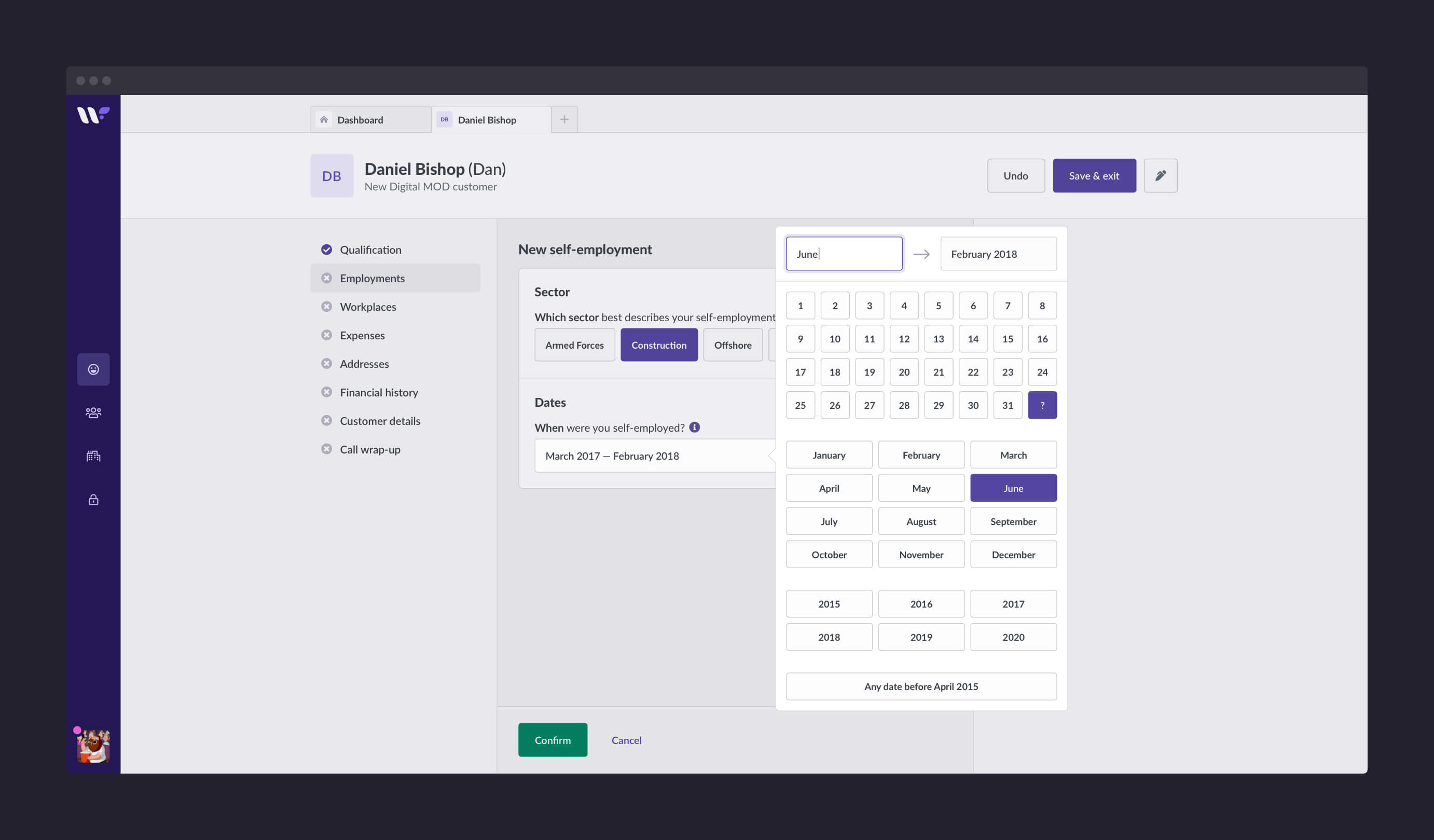

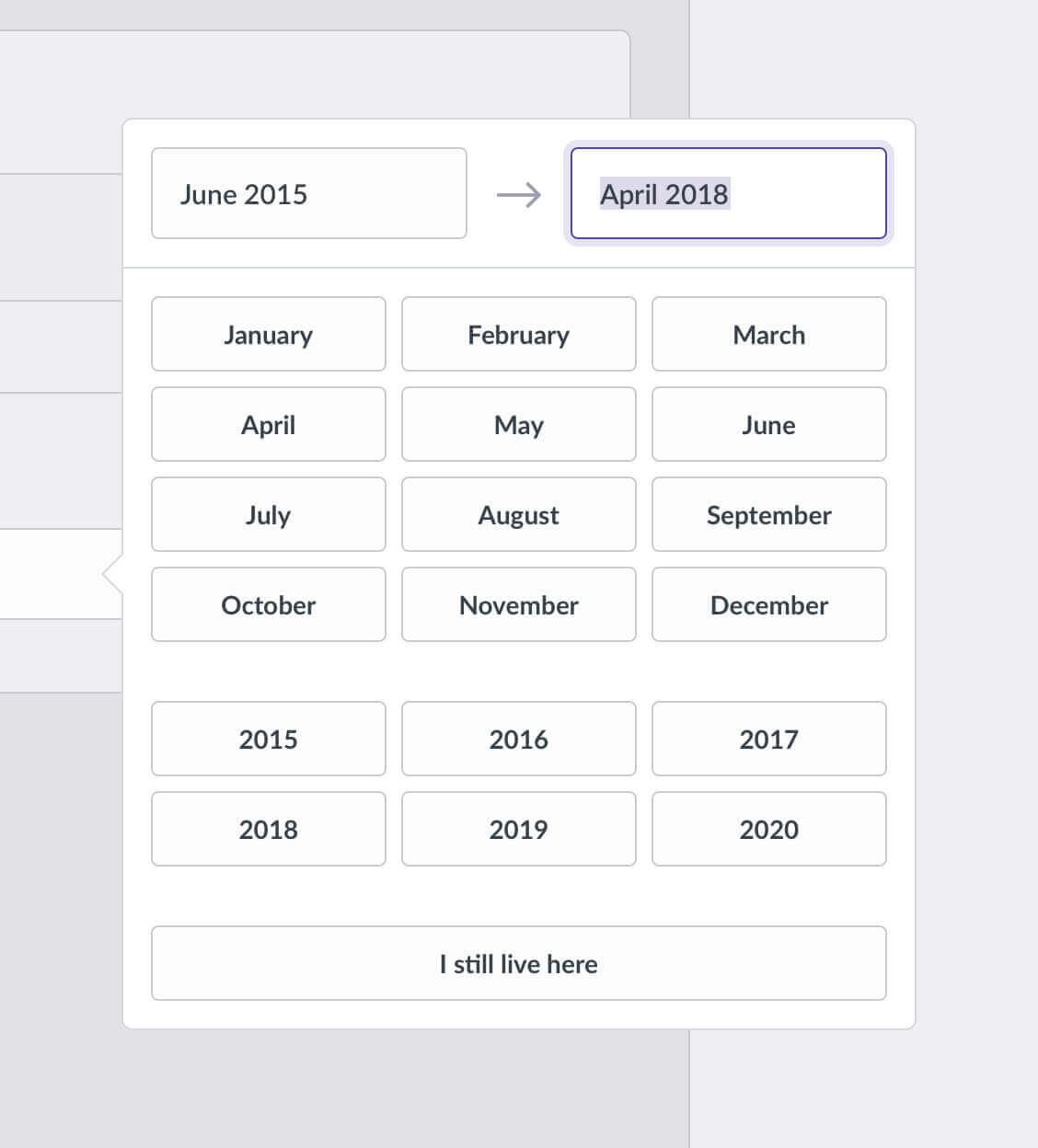

Custom date components

Capturing dates is a major part of the claims process, so it was a priority to let agents enter them efficiently.

In the Conversion Wizard, some dates must be exact, while in other cases month and year are enough. If a date falls before April 2017 (four tax years ago), agents simply confirm it’s outside the period of interest.

This flexibility reduced unnecessary data entry while keeping claims accurate.

Outcome

The Conversion Wizard gave RIFT’s agents a tool that mirrored how calls really flow — guiding interactions, reducing rework, and improving data accuracy.

For me, it was a chance to take a messy, high-volume workflow and design something structured, intuitive, and scalable.